Exhibit 3.1

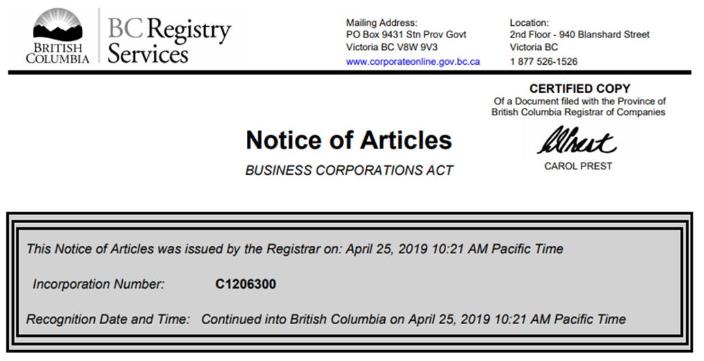

Number:

C1206300

CERTIFICATE

OF

CONTINUATION

BUSINESS CORPORATIONS ACT

I

Hereby Certify that Mezzotin Minerals Inc. , has continued into

British Columbia from the Jurisdiction of ONTARIO, under the

Business Corporations Act, with the name INDUS HOLDINGS, INC. on

April 25, 2019 at 10:21 AM Pacific Time.

|

|

Issued under my hand at Victoria, British Columbia

On April 25, 2019

|

|

/s/ Carol Prest

|

|

Carol Prest

Registrar of Companies

Province of British Columbia

Canada

|

|

ELECTRONIC

CERTIFICATE

|

|

|

|

|

NOTICE OF ARTICLES

|

|

Name of Company:

INDUS

HOLDINGS, INC

|

|

|

|

|

REGISTERED OFFICE INFORMATION

Mailing Address:

2200

HSBC BUILDING, 885 WEST GEORGIA ST.

VANCOUVER

BC V6C 3E8

CANADA

|

Delivery Address:

2200

HSBC BUILDING, 885 WEST GEORGIA ST.

VANCOUVER

BC V6C 3E8

CANADA

|

|

|

|

RECORDS OFFICE INFORMATION

Mailing Address:

2200

HSBC BUILDING, 885 WEST GEORGIA ST.

VANCOUVER

BC V6C 3E8

CANADA

|

Delivery Address:

2200

HSBC BUILDING, 885 WEST GEORGIA ST.

VANCOUVER

BC V6C 3E8

CANADA

|

|

|

|

DIRECTOR INFORMATION

Last Name, First Name, Middle Name:

Ainsworth,

Mark

Mailing Address:

2200

HSBC BUILDING, 885 WEST GEORGIA ST.

VANCOUVER

BC V6C 3E8

CANADA

|

Delivery Address:

2200

HSBC BUILDING, 885 WEST GEORGIA ST.

VANCOUVER

BC V6C 3E8

CANADA

|

|

|

|

Last Name, First Name, Middle Name:

Maxwell,

Arthur

Mailing Address:

2200

HSBC BUILDING, 885 WEST GEORGIA ST.

VANCOUVER

BC V6C 3E8

CANADA

|

Delivery Address:

2200

HSBC BUILDING, 885 WEST GEORGIA ST.

VANCOUVER

BC V6C 3E8

CANADA

|

|

|

|

Last Name, First Name, Middle Name:

Harkness,

Stephanie

Mailing Address:

2200

HSBC BUILDING, 885 WEST GEORGIA ST.

VANCOUVER

BC V6C 3E8

CANADA

|

Delivery Address:

2200

HSBC BUILDING, 885 WEST GEORGIA ST.

VANCOUVER

BC V6C 3E8

CANADA

|

|

|

|

Last Name, First Name, Middle Name:

Anton,

Bill

Mailing Address:

2200

HSBC BUILDING, 885 WEST GEORGIA ST.

VANCOUVER

BC V6C 3E8

CANADA

|

Delivery Address:

2200

HSBC BUILDING, 885 WEST GEORGIA ST.

VANCOUVER

BC V6C 3E8

CANADA

|

|

|

|

Last Name, First Name, Middle Name:

Weakley,

Robert

Mailing Address:

2200

HSBC BUILDING, 885 WEST GEORGIA ST.

VANCOUVER

BC V6C 3E8

CANADA

|

Delivery Address:

2200

HSBC BUILDING, 885 WEST GEORGIA ST.

VANCOUVER

BC V6C 3E8

CANADA

|

|

|

|

Last Name, First Name, Middle Name:

Tramiel,

Sam

Mailing Address:

2200

HSBC BUILDING, 885 WEST GEORGIA ST.

VANCOUVER

BC V6C 3E8

CANADA

|

Delivery Address:

2200

HSBC BUILDING, 885 WEST GEORGIA ST.

VANCOUVER

BC V6C 3E8

CANADA

|

|

|

|

Last Name, First Name, Middle Name:

Maloney,

Tina

Mailing Address:

2200

HSBC BUILDING, 885 WEST GEORGIA ST.

VANCOUVER

BC

CANADA

|

Delivery Address:

2200

HSBC BUILDING, 885 WEST GEORGIA ST.

VANCOUVER

BC V6C 3E8

CANADA

|

|

|

|

AUTHORIZED SHARE STRUCTURE

|

|

|

|

|

|

|

|

|

1. No Maximum

|

Subordinate

Voting Shares

|

Without

Par Value

|

|

|

|

|

|

|

|

|

|

With

Special Rights or Restrictions attached

|

|

|

|

|

|

|

|

|

|

|

|

|

2. No Maximum

|

Super

Voting Shares

|

Without

Par Value

|

|

|

|

|

|

|

|

|

|

With

Special Rights or Restrictions attached

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TABLE OF CONTENTS

Page

|

PART

1

INTERPRETATION

|

8

|

|

1.1

|

Definitions

|

8

|

|

1.2

|

Business Corporations Act and Interpretation Act Definitions

Applicable

|

9

|

|

PART

2

SHARES

AND SHARE CERTIFICATES

|

9

|

|

2.1

|

Authorized Share Structure

|

9

|

|

2.2

|

Form of Share Certificate

|

9

|

|

2.3

|

Shareholder Entitled to Certificate or Acknowledgment

|

9

|

|

2.4

|

Delivery by Mail

|

10

|

|

2.5

|

Replacement of Worn Out or Defaced Certificate or

Acknowledgement

|

10

|

|

2.6

|

Replacement of Lost, Destroyed or Wrongfully Taken

Certificate

|

10

|

|

2.7

|

Recovery of New Share Certificate

|

10

|

|

2.8

|

Splitting Share Certificates

|

11

|

|

2.9

|

Certificate Fee

|

11

|

|

2.10

|

Recognition of Trusts

|

11

|

|

PART

3

ISSUE

OF SHARES

|

11

|

|

3.1

|

Directors Authorized

|

11

|

|

3.2

|

Commissions and Discounts

|

11

|

|

3.3

|

Brokerage

|

11

|

|

3.4

|

Conditions of Issue

|

12

|

|

3.5

|

Share Purchase Warrants and Rights

|

12

|

|

PART

4

SHARE

REGISTERS

|

12

|

|

4.1

|

Central Securities Register

|

12

|

|

4.2

|

Appointment of Agent

|

12

|

|

4.3

|

Closing Register

|

12

|

|

PART

5

SHARE

TRANSFERS

|

13

|

|

5.1

|

Registering Transfers

|

13

|

|

5.2

|

Waivers of Requirements for Transfer

|

13

|

|

5.3

|

Form of Instrument of Transfer

|

13

|

|

5.4

|

Transferor Remains Shareholder

|

14

|

|

5.5

|

Signing of Instrument of Transfer

|

14

|

|

5.6

|

Enquiry as to Title Not Required

|

14

|

|

5.7

|

Transfer Fee

|

14

|

|

PART

6

TRANSMISSION

OF SHARES

|

14

|

|

6.1

|

Legal Personal Representative Recognized on Death

|

14

|

|

6.2

|

Rights of Legal Personal Representative

|

15

|

|

PART

7

ACQUISITION

OF COMPANY’S SHARES

|

15

|

|

7.1

|

Company Authorized to Purchase or Otherwise Acquire

Shares

|

15

|

|

7.2

|

No Purchase, Redemption or Other Acquisition When

Insolvent

|

15

|

|

7.3

|

Sale and Voting of Purchased, Redeemed or Otherwise Acquired

Shares

|

15

|

|

PART

8

BORROWING

POWERS

|

16

|

|

8.1

|

Borrowing Powers

|

16

|

|

8.2

|

Delegation

|

16

|

|

8.3

|

Additional Powers

|

16

|

|

PART

9

ALTERATIONS

|

16

|

|

9.1

|

Alteration of Authorized Share Structure

|

16

|

|

9.2

|

Special Rights or Restrictions

|

17

|

|

9.3

|

No Interference with Class or Series Rights without

Consent

|

18

|

|

9.4

|

Change of Name

|

18

|

|

9.5

|

Other Alterations

|

18

|

|

PART

10

MEETINGS

OF SHAREHOLDERS

|

18

|

|

10.1

|

Annual General Meetings

|

18

|

|

10.2

|

Calling of Meetings of Shareholders

|

18

|

|

10.3

|

Notice for Meetings of Shareholders

|

18

|

|

10.4

|

Failure to Give Notice and Waiver of Notice

|

19

|

|

10.5

|

Notice of Special Business at Meetings of Shareholders

|

19

|

|

10.6

|

Class Meetings and Series Meetings of Shareholders

|

19

|

|

10.7

|

Electronic Meetings

|

19

|

|

10.8

|

Electronic Voting

|

19

|

|

10.9

|

Advance Notice Provisions

|

20

|

|

PART

11

PROCEEDINGS

AT MEETINGS OF SHAREHOLDERS

|

24

|

|

11.1

|

Special Business

|

24

|

|

11.2

|

Special Majority

|

24

|

|

11.3

|

Quorum

|

24

|

|

11.4

|

Persons Entitled to Attend Meeting

|

25

|

|

11.5

|

Requirement of Quorum

|

25

|

|

11.6

|

Lack of Quorum

|

25

|

|

11.7

|

Lack of Quorum at Succeeding Meeting

|

25

|

|

11.8

|

Chair

|

25

|

|

11.9

|

Selection of Alternate Chair

|

25

|

|

11.10

|

Adjournments

|

26

|

|

11.11

|

Notice of Adjourned Meeting

|

26

|

|

11.12

|

Decisions by Show of Hands or Poll

|

26

|

|

11.13

|

Declaration of Result

|

26

|

|

11.14

|

Motion Need Not be Seconded

|

27

|

|

11.15

|

Casting Vote

|

27

|

|

11.16

|

Manner of Taking Poll

|

27

|

|

11.17

|

Chair Must Resolve Dispute

|

27

|

|

11.18

|

Casting of Votes

|

27

|

|

11.19

|

No Demand for Poll on Election of Chair

|

27

|

|

11.20

|

Demand for Poll Not to Prevent Continuance of Meeting

|

28

|

|

11.21

|

Retention of Ballots and Proxies

|

28

|

|

PART

12 VOTES OF SHAREHOLDERS

|

28

|

|

12.1

|

Number of Votes by Shareholder or by Shares

|

28

|

|

12.2

|

Votes of Persons in Representative Capacity

|

28

|

|

12.3

|

Votes by Joint Holders

|

28

|

|

12.4

|

Legal Personal Representatives as Joint Shareholders

|

29

|

|

12.5

|

Representative of a Corporate Shareholder

|

29

|

|

12.6

|

When Proxy Provisions Do Not Apply to the Company

|

29

|

|

12.7

|

Appointment of Proxy Holders

|

29

|

|

12.8

|

Alternate Proxy Holders

|

30

|

|

12.9

|

Deposit of Proxy

|

30

|

|

12.10

|

Validity of Proxy Vote

|

30

|

|

12.11

|

Form of Proxy

|

30

|

|

12.12

|

Revocation of Proxy

|

31

|

|

12.13

|

Revocation of Proxy Must Be Signed

|

31

|

|

12.14

|

Chair May Determine Validity of Proxy.

|

31

|

|

12.15

|

Production of Evidence of Authority to Vote

|

31

|

|

PART

13

DIRECTORS

|

32

|

|

13.1

|

First Directors; Number of Directors

|

32

|

|

13.2

|

Change in Number of Directors

|

32

|

|

13.3

|

Directors’ Acts Valid Despite Vacancy

|

32

|

|

13.4

|

Qualifications of Directors

|

32

|

|

13.5

|

Remuneration of Directors

|

32

|

|

13.6

|

Reimbursement of Expenses of Directors

|

33

|

|

13.7

|

Special Remuneration for Directors

|

33

|

|

13.8

|

Gratuity, Pension or Allowance on Retirement of

Director

|

33

|

|

PART

14

ELECTION

AND REMOVAL OF DIRECTORS

|

33

|

|

14.1

|

Election at Annual General Meeting

|

33

|

|

14.2

|

Consent to be a Director

|

33

|

|

14.3

|

Failure to Elect or Appoint Directors

|

34

|

|

14.4

|

Places of Retiring Directors Not Filled

|

34

|

|

14.5

|

Directors May Fill Casual Vacancies

|

34

|

|

14.6

|

Remaining Directors’ Power to Act

|

34

|

|

14.7

|

Shareholders May Fill Vacancies

|

34

|

|

14.8

|

Additional Directors

|

35

|

|

14.9

|

Ceasing to be a Director

|

35

|

|

14.10

|

Removal of Director by Shareholders

|

35

|

|

14.11

|

Removal of Director by Directors

|

35

|

|

PART

15

POWERS

AND DUTIES OF DIRECTORS

|

35

|

|

15.1

|

Powers of Management

|

35

|

|

15.2

|

Appointment of Attorney of Company

|

36

|

|

PART

16

INTERESTS

OF DIRECTORS AND OFFICERS

|

36

|

|

16.1

|

Obligation to Account for Profits

|

36

|

|

16.2

|

Restrictions on Voting by Reason of Interest

|

36

|

|

16.3

|

Interested Director Counted in Quorum

|

36

|

|

16.4

|

Disclosure of Conflict of Interest or Property

|

36

|

|

16.5

|

Director Holding Other Office in the Company

|

37

|

|

16.6

|

No Disqualification

|

37

|

|

16.7

|

Professional Services by Director or Officer

|

37

|

|

16.8

|

Director or Officer in Other Corporations

|

37

|

|

PART

17

PROCEEDINGS

OF DIRECTORS

|

37

|

|

17.1

|

Meetings of Directors

|

37

|

|

17.2

|

Voting at Meetings

|

37

|

|

17.3

|

Chair of Meetings

|

38

|

|

17.4

|

Meetings by Telephone or Other Communications Medium

|

38

|

|

17.5

|

Calling of Meetings

|

38

|

|

17.6

|

Notice of Meetings

|

38

|

|

17.7

|

When Notice Not Required

|

39

|

|

17.8

|

Meeting Valid Despite Failure to Give Notice

|

39

|

|

17.9

|

Waiver of Notice of Meetings

|

39

|

|

17.10

|

Quorum

|

39

|

|

17.11

|

Validity of Acts Where Appointment Defective

|

39

|

|

17.12

|

Consent Resolutions in Writing

|

39

|

|

PART

18

BOARD

COMMITTEES

|

40

|

|

18.1

|

Appointment and Powers of Committees

|

40

|

|

18.2

|

Obligations of Committees

|

40

|

|

18.3

|

Powers of Board

|

41

|

|

18.4

|

Committee Meetings

|

41

|

|

PART

19

OFFICERS

|

41

|

|

19.1

|

Directors To Appoint Officers

|

41

|

|

19.2

|

Functions, Duties and Powers of Officers

|

41

|

|

19.3

|

Qualifications

|

42

|

|

19.4

|

Remuneration and Terms of Appointment

|

42

|

|

PART

20

INDEMNIFICATION

|

42

|

|

20.1

|

Definitions

|

42

|

|

20.2

|

Mandatory Indemnification of Directors and Officers

|

43

|

|

20.3

|

Deemed Contract

|

43

|

|

20.4

|

Permitted Indemnification

|

43

|

|

20.5

|

Non-Compliance with Business Corporations Act

|

43

|

|

20.6

|

Company May Purchase Insurance

|

43

|

|

PART

21

DIVIDENDS

|

44

|

|

21.1

|

Payment of Dividends Subject to Special Rights

|

44

|

|

21.2

|

Declaration of Dividends

|

44

|

|

21.3

|

No Notice Required

|

44

|

|

21.4

|

Record Date

|

44

|

|

21.5

|

Manner of Paying Dividend

|

44

|

|

21.6

|

Settlement of Difficulties

|

44

|

|

21.7

|

When Dividend Payable

|

44

|

|

21.8

|

Dividends to be Paid in Accordance with Number of

Shares

|

45

|

|

21.9

|

Receipt by Joint Shareholders

|

45

|

|

21.10

|

Dividend Bears No Interest

|

45

|

|

21.11

|

Fractional Dividends

|

45

|

|

21.12

|

Payment of Dividends

|

45

|

|

21.13

|

Capitalization of Retained Earnings or Surplus

|

45

|

|

21.14

|

Unclaimed Dividends

|

45

|

|

PART

22

ACCOUNTING

RECORDS AND AUDITOR

|

46

|

|

22.1

|

Recording of Financial Affairs

|

46

|

|

22.2

|

Inspection of Accounting Records

|

46

|

|

22.3

|

Remuneration of Auditor

|

46

|

|

PART

23

NOTICES

|

46

|

|

23.1

|

Method of Giving Notice

|

46

|

|

23.2

|

Deemed Receipt

|

47

|

|

23.3

|

Certificate of Sending

|

47

|

|

23.4

|

Notice to Joint Shareholders

|

48

|

|

23.5

|

Notice to Legal Personal Representatives and Trustees

|

48

|

|

23.6

|

Undelivered Notices

|

48

|

|

PART

24

SEAL

|

48

|

|

24.1

|

Who May Attest Seal

|

48

|

|

24.2

|

Sealing Copies

|

49

|

|

24.3

|

Mechanical Reproduction of Seal

|

49

|

|

PART

25

EXECUTION

OF INSTRUMENTS

|

49

|

|

25.1

|

Cheques, Drafts, Notes, Etc.

|

49

|

|

25.2

|

Execution of Contracts, Etc.

|

49

|

|

PART

26

FORUM

SELECTION

|

50

|

|

26.1

|

Forum for Adjudication of Certain Disputes

|

50

|

|

PART

27

SPECIAL

RIGHTS AND RESTRICTIONS OF SHARES

|

50

|

|

27.1

|

Subordinate Voting Shares

|

50

|

|

27.2

|

Super Voting Shares

|

51

|

Incorporation Number C1206300

ARTICLES

OF

INDUS HOLDINGS,

INC.

(the

“Company”)

The

Company will have as its Articles upon continuation the following

Articles.

|

Full name and signature of Director

|

Date of Signing

|

|

/s/

Lawrence Schreiner

|

April

25, 2019

|

PART 1

In

these Articles (the “Articles”), unless the context

otherwise requires:

(1)

“appropriate

person” has the meaning assigned in the Securities Transfer Act;

(2)

“board of directors”,

“directors” and “board” mean the directors of the Company

for the time being;

(3)

“Business Corporations

Act” means

the Business Corporations

Act (British Columbia) from time to time in force and all

amendments thereto and includes all regulations and amendments

thereto made pursuant to that Act;

(4)

“Interpretation

Act” means

the Interpretation Act

(British Columbia) from time to time in force and all amendments

thereto and includes all regulations and amendments thereto made

pursuant to that Act;

(5)

“legal personal

representative” means the personal or other legal

representative of a shareholder;

(6)

“protected purchaser” has the meaning assigned in the

Securities Transfer

Act;

(7)

“registered address” of a shareholder means the

shareholder’s address

as recorded in the central securities register;

(8)

“seal” means the seal of the Company, if

any;

(9)

“Securities

Act” means

the Securities Act (British

Columbia) from time to time in force and all amendments thereto and

includes all regulations and amendments thereto made pursuant to

that Act;

(10)

“securities legislation” means

statutes concerning the regulation of securities markets and

trading in securities and the regulations, rules, forms and

schedules under those statutes, all as amended from time to time,

and the blanket rulings and orders, as amended from time to time,

issued by the securities commissions or similar regulatory

authorities appointed under or pursuant to those statutes; and

“Canadian securities

legislation” means the securities legislation in any

province or territory of Canada and includes the Securities Act; and;

(11)

“Securities Transfer

Act” means the Securities Transfer Act (British

Columbia) from time to time in force and all amendments thereto and

includes all regulations and amendments thereto made pursuant to

that Act.

1.2

Business

Corporations Act and Interpretation Act Definitions

Applicable

The

definitions in the Business

Corporations Act and the definitions and rules of

construction in the Interpretation

Act, with the necessary changes, so far as applicable, and

unless the context requires otherwise, apply to these Articles as

if they were an enactment. If there is a conflict between a

definition in the Business

Corporations Act and a definition or rule in the

Interpretation Act relating

to a term used in these Articles, the definition in the

Business Corporations Act

will prevail in relation to the use of the term in these Articles.

If there is a conflict or inconsistency between these Articles and

the Business Corporations

Act, the Business

Corporations Act will prevail.

PART 2

SHARES AND SHARE

CERTIFICATES

2.1

Authorized

Share Structure

The

authorized share structure of the Company consists of shares of the

class or classes and series, if any, described in the Notice of

Articles of the Company.

2.2

Form

of Share Certificate

Each

share certificate issued by the Company must comply with, and be

signed as required by, the Business Corporations Act.

2.3

Shareholder

Entitled to Certificate or Acknowledgment

Unless

the shares of which the shareholder is the registered owner are

uncertificated shares within the meaning of the Business Corporations Act, each

shareholder is entitled, without charge, to (a) one share

certificate representing the shares of each class or series of

shares registered in the shareholder’s name or (b) a

non-transferable written acknowledgment of the shareholder’s

right to obtain such a share certificate, provided that in respect

of a share held jointly by several persons, the Company is not

bound to issue more than one share certificate or acknowledgment

and delivery of a share certificate or an acknowledgment to one of

several joint shareholders or to a duly authorized agent of one of

the joint shareholders will be sufficient delivery to all. If a

shareholder is the registered owner of uncertificated shares, the

Company must send to that holder a written notice containing the

information required by the Act within a reasonable time after the

issue or transfer of the shares.

Any

share certificate or non-transferable written acknowledgment of a

shareholder’s right to obtain a share certificate may be sent

to the shareholder by mail at the shareholder’s registered

address and neither the Company nor any director, officer or agent

of the Company (including the Company’s legal counsel or

transfer agent) is liable for any loss to the shareholder because

the share certificate or acknowledgement is lost in the mail or

stolen.

2.5

Replacement

of Worn Out or Defaced Certificate or Acknowledgement

If the

Company is satisfied that a share certificate or a non-transferable

written acknowledgment of the shareholder’s right to obtain a

share certificate is worn out or defaced, it must, on production to

it of the share certificate or acknowledgment, as the case may be,

and on such other terms, if any, as it thinks fit:

(1)

order the share

certificate or acknowledgment, as the case may be, to be cancelled;

and

(2)

issue a replacement

share certificate or acknowledgment, as the case may

be.

2.6

Replacement

of Lost, Destroyed or Wrongfully Taken Certificate

If a

person entitled to a share certificate claims that the share

certificate has been lost, destroyed or wrongfully taken, the

Company must issue a new share certificate, if that

person:

(1)

so requests before

the Company has notice that the share certificate has been acquired

by a protected purchaser;

(2)

provides the

Company with an indemnity bond sufficient in the Company’s

judgement to protect the Company from any loss that the Company may

suffer by issuing a new certificate; and

(3)

satisfies any other

reasonable requirements imposed by the Company.

A

person entitled to a share certificate may not assert against the

Company a claim for a new share certificate where a share

certificate has been lost, apparently destroyed or wrongfully taken

if that person fails to notify the Company of that fact within a

reasonable time after that person has notice of it and the Company

registers a transfer of the shares represented by the certificate

before receiving a notice of the loss, apparent destruction or

wrongful taking of the share certificate.

2.7

Recovery

of New Share Certificate

If,

after the issue of a new share certificate, a protected purchaser

of the original share certificate presents the original share

certificate for the registration of transfer, then in addition to

any rights under any indemnity bond, the Company may recover the

new share certificate from a person to whom it was issued or any

person taking under that person other than a protected

purchaser.

2.8

Splitting

Share Certificates

If a

shareholder surrenders a share certificate to the Company with a

written request that the Company issue in the shareholder’s

name two or more share certificates, each representing a specified

number of shares and in the aggregate representing the same number

of shares as represented by the share certificate so surrendered,

the Company must cancel the surrendered share certificate and issue

replacement share certificates in accordance with that

request.

There

must be paid to the Company, in relation to the issue of any share

certificate under Articles 2.5, 2.6 or 2.8, the amount, if any and

which must not exceed the amount prescribed under the Business Corporations Act, determined

by the directors.

2.10

Recognition

of Trusts

Except

as required by law or statute or these Articles, no person will be

recognized by the Company as holding any share upon any trust, and

the Company is not bound by or compelled in any way to recognize

(even when having notice thereof) any equitable, contingent, future

or partial interest in any share or fraction of a share or (except

as required by law or statute or these Articles or as ordered by a

court of competent jurisdiction) any other rights in respect of any

share except an absolute right to the entirety thereof in the

shareholder.

PART 3

ISSUE OF

SHARES

Subject

to the Business Corporations

Act and the rights, if any, of the holders of issued shares

of the Company, the Company may issue, allot, sell or otherwise

dispose of the unissued shares, and issued shares held by the

Company, at the times, to the persons, including directors, in the

manner, on the terms and conditions and for the issue prices

(including any premium at which shares with par value may be

issued) that the directors may determine. The issue price for a

share with par value must be equal to or greater than the par value

of the share.

3.2

Commissions

and Discounts

The

Company may at any time pay a reasonable commission or allow a

reasonable discount to any person in consideration of that person

purchasing or agreeing to purchase shares of the Company from the

Company or any other person or procuring or agreeing to procure

purchasers for shares of the Company.

The

Company may pay such brokerage fee or other consideration as may be

lawful for or in connection with the sale or placement of its

securities.

Except

as provided for by the Business

Corporations Act, no share may be issued until it is fully

paid. A share is fully paid when:

(1)

consideration is

provided to the Company for the issue of the share by one or more

of the following:

(a)

past services

performed for the Company;

(2)

the value of the

consideration received by the Company equals or exceeds the issue

price set for the share under Article 3.1.

3.5

Share

Purchase Warrants and Rights

Subject

to the Business Corporations

Act, the Company may issue share purchase warrants, options

and rights upon such terms and conditions as the directors

determine, which share purchase warrants, options and rights may be

issued alone or in conjunction with debentures, debenture stock,

bonds, shares or any other securities issued or created by the

Company from time to time.

PART 4

SHARE

REGISTERS

4.1

Central

Securities Register

As

required by and subject to the Business Corporations Act, the Company

must maintain a central securities register, which may be kept in

electronic form.

The

directors may, subject to the Business Corporations Act, appoint an

agent to maintain the central securities register. The directors

may also appoint one or more agents, including the agent which

keeps the central securities register, as transfer agent for its

shares or any class or series of its shares, as the case may be,

and the same or another agent as registrar for its shares or such

class or series of its shares, as the case may be. The directors

may terminate such appointment of any agent at any time and may

appoint another agent in its place.

If the

Company has appointed a transfer agent, references in Articles 2.4,

2.5, 2.6, 2.7, 2.8, 2.9, and 5.7 to the Company include its

transfer agent.

The

Company must not at any time close its central securities

register.

PART 5

SHARE

TRANSFERS

5.1

Registering

Transfers

The

Company must register a transfer of a share of the Company if

either:

(1)

the Company or the

transfer agent or registrar for the class or series of share to be

transferred has received:

(a)

in the case where

the Company has issued a share certificate in respect of the share

to be transferred, that share certificate and a written instrument

of transfer (which may be on a separate document or endorsed on the

share certificate) made by the shareholder or other appropriate

person or by an agent who has actual authority to act on behalf of

that person;

(b)

in the case of a

share that is not represented by a share certificate (including an

uncertificated share within the meaning of the Business Corporations Act and including

the case where the Company has issued a non-transferable written

acknowledgement of the shareholder’s right to obtain a share

certificate in respect of the share to be transferred), a written

instrument of transfer, made by the shareholder or other

appropriate person or by an agent who has actual authority to act

on behalf of that person; and

(c)

such other

evidence, if any, as the Company or the transfer agent or registrar

for the class or series of share to be transferred may require to

prove the title of the transferor or the transferor’s right

to transfer the share, that the written instrument of transfer is

genuine and authorized and that the transfer is rightful or to a

protected purchaser; or

(2)

all the

preconditions for a transfer of a share under the Securities Transfer Act have been met

and the Company is required under the Securities Transfer Act to register the

transfer.

5.2

Waivers

of Requirements for Transfer

The

Company may waive any of the requirements set out in Article 5.1(1)

and any of the preconditions referred to in Article

5.1(2).

5.3

Form

of Instrument of Transfer

The

instrument of transfer in respect of any share of the Company must

be either in the form, if any, on the back of the Company’s

share certificates or in any other form that may be approved by the

Company or the transfer agent for the class or series of shares to

be transferred.

5.4

Transferor

Remains Shareholder

Except

to the extent that the Business

Corporations Act otherwise provides, the transferor of

shares is deemed to remain the holder of the shares until the name

of the transferee is entered in a securities register of the

Company in respect of the transfer.

5.5

Signing

of Instrument of Transfer

If a

shareholder or other appropriate person or an agent who has actual

authority to act on behalf of that person, signs an instrument of

transfer in respect of shares registered in the name of the

shareholder, the signed instrument of transfer constitutes a

complete and sufficient authority to the Company and its directors,

officers and agents to register the number of shares specified in

the instrument of transfer or specified in any other manner, or, if

no number is specified but share certificates are deposited with

the instrument of transfer, all the shares represented by such

share certificates:

(1)

in the name of the

person named as transferee in that instrument of transfer;

or

(2)

if no person is

named as transferee in that instrument of transfer, in the name of

the person on whose behalf the instrument is deposited for the

purpose of having the transfer registered.

5.6

Enquiry

as to Title Not Required

Neither

the Company nor any director, officer or agent of the Company is

bound to inquire into the title of the person named in the

instrument of transfer as transferee or, if no person is named as

transferee in the instrument of transfer, of the person on whose

behalf the instrument is deposited for the purpose of having the

transfer registered or is liable for any claim related to

registering the transfer by the shareholder or by any intermediate

owner or holder of the shares, of any interest in the shares, of

any share certificate representing such shares or of any written

acknowledgment of a right to obtain a share certificate for such

shares.

Subject

to the applicable rules of any stock exchange on which the shares

of the Company may be listed, there must be paid to the Company, in

relation to the registration of any transfer, the amount, if any,

determined by the directors.

PART 6

TRANSMISSION OF

SHARES

6.1

Legal

Personal Representative Recognized on Death

In the

case of the death of a shareholder, the legal personal

representative of the shareholder, or in the case of shares

registered in the shareholder’s name and the name of another

person in joint tenancy, the surviving joint holder, will be the

only person recognized by the Company as having any title to the

shareholder’s interest in the shares. Before recognizing a

person as a legal personal representative of a shareholder, the

directors may require the original grant of probate or letters of

administration or a court certified copy of them or the original or

a court certified or authenticated copy of the grant of

representation, will, order or other instrument or other evidence

of the death under which title to the shares or securities is

claimed to vest.

6.2

Rights

of Legal Personal Representative

The

legal personal representative of a shareholder has the rights,

privileges and obligations that attach to the shares held by the

shareholder, including the right to transfer the shares in

accordance with these Articles and applicable securities

legislation, if appropriate evidence of appointment or incumbency

within the meaning of the Securities Transfer Act and the

documents required by the Act and the directors have been deposited

with the Company. This Article 6.2 does not apply in the case of

the death of a shareholder with respect to shares registered in the

shareholder’s name and the name of another person in joint

tenancy.

PART 7

ACQUISITION OF

COMPANY’S SHARES

7.1

Company

Authorized to Purchase or Otherwise Acquire Shares

Subject

to Article 7.2, the special rights or restrictions attached to the

shares of any class or series of shares, the Business Corporations Act and

applicable securities legislation, the Company may, if authorized

by the directors, purchase or otherwise acquire any of its shares

at the price and upon the terms determined by the

directors.

7.2

No

Purchase, Redemption or Other Acquisition When

Insolvent

The

Company must not make a payment or provide any other consideration

to purchase, redeem or otherwise acquire any of its shares if there

are reasonable grounds for believing that:

(1)

the Company is

insolvent; or

(2)

making the payment

or providing the consideration would render the Company

insolvent.

7.3

Sale

and Voting of Purchased, Redeemed or Otherwise Acquired

Shares

If the

Company retains a share redeemed, purchased or otherwise acquired

by it, the Company may sell or otherwise dispose of the share, but,

while such share is held by the Company, it:

(1)

is not entitled to

vote the share at a meeting of its shareholders;

(2)

must not pay a

dividend in respect of the share; and

(3)

must not make any

other distribution in respect of the share.

PART 8

BORROWING

POWERS

The

Company, if authorized by the directors, may:

(1)

borrow money in the

manner and amount, on the security, from the sources and on the

terms and conditions that the directors consider

appropriate;

(2)

issue bonds,

debentures and other debt obligations either outright or as

security for any liability or obligation of the Company or any

other person and at such discounts or premiums and on such other

terms as the directors consider appropriate;

(3)

guarantee the

repayment of money by any other person or the performance of any

obligation of any other person; and

(4)

mortgage,

hypothecate, charge, whether by way of specific or floating charge,

grant a security interest in, or give other security on, the whole

or any part of the present and future assets and undertaking of the

Company, including property that is movable or immovable, corporeal

or incorporeal.

The

directors may from time to time delegate to such one or more of the

directors or officers of the Company as may be designated by the

board of directors all or any of the powers conferred on the board

by Article 8.1 or by the Act to such extent and in such manner as

the directors shall determine from time to time.

The

powers conferred under this Part 8 shall be deemed to include the

powers conferred on a company by Division VII of the Act Respecting the Special Powers of Legal

Persons being chapter P-16 of the Revised Statutes of

Quebec, and every statutory provision that may be substituted

therefor or for any provision therein.

PART 9

ALTERATIONS

9.1

Alteration

of Authorized Share Structure

Subject

to Articles 9.2 and 9.3, the special rights or restrictions

attached to the shares of any class or series of shares and the

Business Corporations Act,

the Company may:

(1)

by ordinary

resolution:

(a)

create one or more

classes or series of shares or, if none of the shares of a class or

series of shares are allotted or issued, eliminate that class or

series of shares;

(b)

increase, reduce or

eliminate the maximum number of shares that the Company is

authorized to issue out of any class or series of shares or

establish a maximum number of shares that the Company is authorized

to issue out of any class or series of shares for which no maximum

is established;

(c)

if the Company is

authorized to issue shares of a class of shares with par

value:

(i)

decrease the par

value of those shares; or

(ii)

if none of the

shares of that class of shares are allotted or issued, increase the

par value of those shares;

(d)

change all or any

of its unissued, or fully paid issued, shares with par value into

shares without par value or any of its unissued shares without par

value into shares with par value; or

(e)

otherwise alter its

shares or authorized share structure when required or permitted to

do so by the Business Corporations

Act;

and, if

applicable, alter its Notice of Articles and Articles accordingly;

or

(2)

by resolution of

the directors:

(a)

subdivide or

consolidate all or any of its unissued, or fully paid issued,

shares; or

(b)

alter the

identifying name of any of its shares;

and if

applicable, alter its Notice of Articles and, if applicable, its

Articles accordingly.

9.2

Special

Rights or Restrictions

Subject

to the special rights or restrictions attached to any class or

series of shares and the Business

Corporations Act, the Company may by ordinary

resolution:

(1)

create special

rights or restrictions for, and attach those special rights or

restrictions to, the shares of any class or series of shares,

whether or not any or all of those shares have been issued;

or

(2)

vary or delete any

special rights or restrictions attached to the shares of any class

or series of shares, whether or not any or all of those shares have

been issued;

and

alter its Articles and Notice of Articles accordingly.

9.3

No

Interference with Class or Series Rights without

Consent

A right

or special right attached to issued shares must not be prejudiced

or interfered with under the Business Corporations Act, the Notice

of Articles or these Articles unless the holders of shares of the

class or series of shares to which the right or special right is

attached consent by a special separate resolution of the holders of

such class or series of shares.

The

Company may by directors’ resolution or ordinary resolution

authorize an alteration to its Notice of Articles in order to

change its name.

If the

Business Corporations Act

does not specify the type of resolution and these Articles do not

specify another type of resolution, the Company may by ordinary

resolution alter these Articles.

PART 10

MEETINGS OF

SHAREHOLDERS

10.1

Annual

General Meetings

Unless

an annual general meeting is deferred or waived in accordance with

the Business Corporations

Act, the Company must hold an annual general meeting at

least once in each calendar year and not more than 15 months after

the last annual reference date at such time and place, whether in

or outside of British Columbia, as may be determined by the

directors.

10.2

Calling

of Meetings of Shareholders

The

directors may, at any time, call a meeting of shareholders, to be

held at such time and place, whether in or outside of British

Columbia, as may be determined by the directors.

10.3

Notice

for Meetings of Shareholders

The

Company must send notice of the date, time and location of any

meeting of shareholders (including, without limitation, any notice

specifying the intention to propose a resolution as an exceptional

resolution, a special resolution or a special separate resolution,

and any notice to consider approving an amalgamation into a foreign

jurisdiction, an arrangement or the adoption of an amalgamation

agreement, and any notice of a general meeting, class meeting or

series meeting), in the manner provided in these Articles, or in

such other manner, if any, as may be prescribed by ordinary

resolution (whether previous notice of the resolution has been

given or not), to each shareholder entitled to attend the meeting,

to each director and to the auditor of the Company, unless these

Articles otherwise provide, at least 21 days before the

meeting.

10.4

Failure

to Give Notice and Waiver of Notice

The

accidental omission to send notice of any meeting of shareholders

to, or the non-receipt of any notice by, any of the persons

entitled to notice does not invalidate any proceedings at that

meeting. Any person entitled to notice of a meeting of shareholders

may, in writing or otherwise, waive that entitlement or agree to

reduce the period of that notice. Attendance of a person at a

meeting of shareholders is a waiver of entitlement to notice of the

meeting unless that person attends the meeting for the express

purpose of objecting to the transaction of any business on the

grounds that the meeting is not lawfully called.

10.5

Notice

of Special Business at Meetings of Shareholders

If a

meeting of shareholders is to consider special business within the

meaning of Article 11.1, the notice of meeting must:

(1)

state the general

nature of the special business; and

(2)

if the special

business includes considering, approving, ratifying, adopting or

authorizing any document or the signing of or giving of effect to

any document, have attached to it a copy of the document or state

that a copy of the document will be available for inspection by

shareholders:

(a)

at the

Company’s records office, or at such other reasonably

accessible location in British Columbia as is specified in the

notice; and

(b)

during statutory

business hours on any one or more specified days before the day set

for the holding of the meeting.

10.6

Class

Meetings and Series Meetings of Shareholders

Unless

otherwise specified in these Articles, the provisions of these

Articles relating to a meeting of shareholders will apply, with the

necessary changes and so far as they are applicable, to a class

meeting or series meeting of shareholders holding a particular

class or series of shares.

The

directors may determine that a meeting of shareholders shall be

held entirely by means of telephone, electronic or other

communication facilities that permit all participants to

communicate with each other during the meeting. A meeting of

shareholders may also be held at which some, but not necessarily

all, persons entitled to attend may participate by means of such

communication facilities, if the directors determine to make them

available. A person participating in a meeting by such means is

deemed to be present at the meeting.

Any

vote at a meeting of shareholders may be held entirely or partially

by means of telephone, electronic or other communication

facilities, if the directors determine to make them available,

whether or not persons entitled to attend participate in the

meeting by means of communication facilities.

10.9

Advance

Notice Provisions

(1)

Nomination of

Directors

Subject

only to the Business Corporations

Act and these Articles, only persons who are nominated in

accordance with the procedures set out in this Article 10.9 shall

be eligible for election as directors to the board of directors of

the Company. Nominations of persons for election to the board may

only be made at an annual meeting of shareholders, or at a special

meeting of shareholders called for any purpose at which the

election of directors is a matter specified in the notice of

meeting, as follows:

(a)

by or at the

direction of the board (or any duly authorized committee thereof)

or an authorized officer of the Company, including pursuant to a

notice of meeting;

(b)

by or at the

direction or request of one or more shareholders pursuant to a

valid proposal made in accordance with the provisions of the

Business Corporations Act

or a valid requisition of shareholders made in accordance with the

provisions of the Business

Corporations Act; or

(c)

by any person

entitled to vote at such meeting (a “Nominating Shareholder”),

who:

(i)

is, at the close of

business on the date of giving notice provided for in this Article

10.9 and on the record date for notice of such meeting, either

entered in the securities register of the Company as a holder of

one or more shares carrying the right to vote at such meeting or

who beneficially owns shares that are entitled to be voted at such

meeting and provides evidence of such beneficial ownership to the

Company; and

(ii)

has given timely

notice in proper written form as set forth in this Article

10.9.

For the

avoidance of doubt, this Article 10.9 shall be the exclusive means

for any person to bring nominations for election to the board

before any annual or special meeting of shareholders of the

Company.

In

order for a nomination made by a Nominating Shareholder to be

timely notice (a “Timely

Notice”), the Nominating Shareholder’s notice

must be received by the corporate secretary of the Company at the

principal executive offices or registered office of the

Company:

(a)

in the case of an

annual meeting of shareholders (including an annual and special

meeting), not later than 5:00 p.m. (Vancouver time) on the 60th day

before the date of the meeting; provided, however, if the first

public announcement made by the Company of the date of the meeting

(each such date being the “Notice Date”) is less than 50 days

before the meeting date, notice by the Nominating Shareholder may

be given not later than the close of business on the 20th day

following the Notice Date; and

(b)

in the case of a

special meeting (which is not also an annual meeting) of

shareholders called for any purpose which includes the election of

directors to the board, not later than the close of business on the

15th day following the Notice Date;

provided

that, in either instance, if notice-and-access (as defined in

National Instrument 54-101 - Communication with Beneficial Owners of

Securities of a Reporting Issuer) is used for delivery of

proxy related materials in respect of a meeting described in

Article 10.9(3)(a) or 10.9(3)(b), and the Notice Date in respect of

the meeting is not less than 50 days before the date of the

applicable meeting, the notice must be received not later than the

close of business on the 40th day before the date of the applicable

meeting.

(4)

Proper Form of

Notice

To be

in proper written form, a Nominating Shareholder’s notice to

the corporate secretary must comply with all the provisions of this

Article 10.9 and disclose or include, as applicable:

(a)

as to each person

whom the Nominating Shareholder proposes to nominate for election

as a director (a “Proposed

Nominee”):

(i)

the name, age,

business and residential address of the Proposed

Nominee;

(ii)

the principal

occupation/business or employment of the Proposed Nominee, both

presently and for the past five years;

(iii)

the number of

securities of each class of securities of the Company beneficially

owned, or controlled or directed, directly or indirectly, by the

Proposed Nominee, as of the record date for the meeting of

shareholders (if such date shall then have been made publicly

available and shall have occurred) and as of the date of such

notice;

(iv)

full particulars of

any relationships, agreements, arrangements or understandings

(including financial, compensation or indemnity related) between

the Proposed Nominee and the Nominating Shareholder, or any

affiliates or associates of, or any person or entity acting jointly

or in concert with, the Proposed Nominee or the Nominating

Shareholder;

(v)

any other

information that would be required to be disclosed in a dissident

proxy circular or other filings required to be made in connection

with the solicitation of proxies for election of directors pursuant

to the Business Corporations

Act or applicable securities law; and

(vi)

a written consent

of each Proposed Nominee to being named as nominee and certifying

that such Proposed Nominee is not disqualified from acting as

director under the provisions of subsection 124(2) of the

Business Corporations Act;

and

(b)

as to each

Nominating Shareholder giving the notice, and each beneficial

owner, if any, on whose behalf the nomination is made:

(i)

their name,

business and residential address;

(ii)

the number of

securities of the Company or any of its subsidiaries beneficially

owned, or controlled or directed, directly or indirectly, by the

Nominating Shareholder or any other person with whom the Nominating

Shareholder is acting jointly or in concert with respect to the

Company or any of its securities, as of the record date for the

meeting of shareholders (if such date shall then have been made

publicly available and shall have occurred) and as of the date of

such notice;

(iii)

their interests in,

or rights or obligations associated with, any agreement,

arrangement or understanding, the purpose or effect of which is to

alter, directly or indirectly, the person’s economic interest

in a security of the Company or the person’s economic

exposure to the Company;

(iv)

any relationships,

agreements or arrangements, including financial, compensation and

indemnity related relationships, agreements or arrangements,

between the Nominating Shareholder or any affiliates or associates

of, or any person or entity acting jointly or in concert with, the

Nominating Shareholder and any Proposed Nominee;

(v)

full particulars of

any proxy, contract, relationship arrangement, agreement or

understanding pursuant to which such person, or any of its

affiliates or associates, or any person acting jointly or in

concert with such person, has any interests, rights or obligations

relating to the voting of any securities of the Company or the

nomination of directors to the board;

(vi)

a representation

that the Nominating Shareholder is a holder of record of securities

of the Company, or a beneficial owner, entitled to vote at such

meeting, and intends to appear in person or by proxy at the meeting

to propose such nomination;

(vii)

a representation as

to whether such person intends to deliver a proxy circular and/or

form of proxy to any shareholder of the Company in connection with

such nomination or otherwise solicit proxies or votes from

shareholders of the Company in support of such nomination;

and

(viii)

any other

information relating to such person that would be required to be

included in a dissident proxy circular or other filings required to

be made in connection with solicitations of proxies for election of

directors pursuant to the Business

Corporations Act or as required by applicable securities

law.

Reference

to “Nominating

Shareholder” in this Article 10.9(4) shall be deemed

to refer to each shareholder that nominated or seeks to nominate a

person for election as director in the case of a nomination

proposal where more than one shareholder is involved in making the

nomination proposal.

(5)

Currency of Nominee

Information

All

information to be provided in a Timely Notice pursuant to this

Article 10.9 shall be provided as of the date of such notice. The

Nominating Shareholder shall provide the Company with an update to

such information forthwith so that it is true and correct in all

material respects as of the date that is 10 business days before

the date of the meeting, or any adjournment or postponement

thereof.

(6)

Delivery of

Information

Notwithstanding

Part 23 of these Articles, any notice, or other document or

information required to be given to the corporate secretary

pursuant to this Article 10.9 may only be given by personal

delivery to the Company’s registered office (or such other

email address as stipulated from time to time by the Company for

the purposes of such notice) and shall be deemed to have been given

and made on the date of delivery if it is a business day and the

delivery was made prior to 5:00 p.m. in the city where the

Company’s registered office is located and otherwise on the

next business day.

(7)

Defective

Nomination Determination

The

chair of any meeting of shareholders of the Company shall have the

power to determine whether any proposed nomination is made in

accordance with the provisions of this Article 10.9, and if any

proposed nomination is not in compliance with such provisions, must

as soon as practicable following receipt of such nomination and

prior to the meeting declare that such defective nomination shall

not be considered at any meeting of shareholders.

Despite

any other provision of this Article 10.9, if the Nominating

Shareholder (or a duly appointed proxy holder for the Nominating

Shareholder or representative of the Nominating Shareholder

appointed under Article 12.5) does not appear at the meeting of

shareholders of the Company to present the nomination, such

nomination shall be disregarded, notwithstanding that proxies in

respect of such nomination may have been received by the

Company.

The

board may, in its sole discretion, waive any requirement in this

Article 10.9.

For the

purposes of this Article 10.9, “public announcement” means disclosure in a news release

disseminated by the Company through a national news service in

Canada, or in a document filed by the Company for public access

under its profile on the System of Electronic Document Analysis and

Retrieval at www.sedar.com.

PART 11

PROCEEDINGS AT

MEETINGS OF SHAREHOLDERS

At a

meeting of shareholders, the following business is special

business:

(1)

at a meeting of

shareholders that is not an annual general meeting, all business is

special business except business relating to the conduct of or

voting at the meeting;

(2)

at an annual

general meeting, all business is special business except for the

following:

(a)

business relating

to the conduct of or voting at the meeting;

(b)

consideration of

any financial statements of the Company presented to the

meeting;

(c)

consideration of

any reports of the directors or auditor;

(d)

the election or

appointment of directors;

(e)

the appointment of

an auditor;

(f)

the setting of the

remuneration of an auditor;

(g)

business arising

out of a report of the directors not requiring the passing of a

special resolution or an exceptional resolution; and

(h)

any non-binding

advisory vote (i) proposed by the Company, (ii) required by the

rules of any stock exchange on which securities of the Company are

listed, or (iii) required by applicable Canadian securities

legislation.

The

majority of votes required for the Company to pass a special

resolution at a general meeting of shareholders is two-thirds of

the votes cast on the resolution.

Subject

to the special rights or restrictions attached to the shares of any

class or series of shares, a quorum for the transaction of business

at a meeting of shareholders is present if at least two

shareholders who, in the aggregate, hold or represent in aggregate

not less than 20% of the issued shares entitled to be voted at the

meeting are present in person or represented by proxy, irrespective

of the number of persons actually present at the

meeting.

11.4

Persons

Entitled to Attend Meeting

In

addition to those persons who are entitled to vote at a meeting of

shareholders, the only other persons entitled to be present at the

meeting are the directors, the officers, any lawyer for the

Company, the auditor of the Company, any persons invited to be

present at the meeting by the directors or by the chair of the

meeting and any persons entitled or required under the Business Corporations Act or these

Articles to be present at the meeting; but if any of those persons

does attend the meeting, that person is not to be counted in the

quorum and is not entitled to vote at the meeting unless that

person is a shareholder or proxy holder entitled to vote at the

meeting.

11.5

Requirement

of Quorum

No

business, other than the election of a chair of the meeting and the

adjournment of the meeting, may be transacted at any meeting of

shareholders unless a quorum of shareholders entitled to vote is

present at the commencement of the meeting, but such quorum need

not be present throughout the meeting.

If,

within one-half hour from the time set for the holding of a meeting

of shareholders, a quorum is not present:

(1)

in the case of a

meeting requisitioned by shareholders, the meeting is dissolved,

and

(2)

in the case of any

other meeting of shareholders, the meeting stands adjourned to the

time and place determined by the chair of the board or by the

directors.

11.7

Lack

of Quorum at Succeeding Meeting

If, at

the meeting to which the meeting referred to in Article 11.6(2) was

adjourned, a quorum is not present within one-half hour from the

time set for the holding of the meeting, the person or persons

present and being or representing by proxy one or more shareholders

entitled to attend at vote at the meeting constitute a

quorum.

The

following individual is entitled to preside as chair at a meeting

of shareholders:

(1)

the chair of the

board, if any; or

(2)

if the chair of the

board is absent or unwilling to act as chair of the meeting, the

president, if any.

11.9

Selection

of Alternate Chair

If, at

any meeting of shareholders,

(1)

there is no chair

of the board or president present within 15 minutes after the time

set for holding the meeting, or

(2)

if the chair of the

board and the president are unwilling to act as chair of the

meeting, or

(3)

if the chair of the

board and the president have advised the corporate secretary, if

any, or any director present at the meeting, that they will not be

present at the meeting,

the

directors present must choose one of their number to be chair of

the meeting or if all of the directors present decline to take the

chair or fail to so choose or if no director is present, the

shareholders entitled to vote at the meeting who are present in

person or by proxy may choose any person present at the meeting to

chair the meeting.

The

chair of a meeting of shareholders may, and if so directed by the

meeting must, adjourn the meeting from time to time and from place

to place, but no business may be transacted at any adjourned

meeting other than the business left unfinished at the meeting from

which the adjournment took place.

11.11

Notice

of Adjourned Meeting

It is

not necessary to give any notice of an adjourned meeting of

shareholders or of the business to be transacted at an adjourned

meeting of shareholders except that, when a meeting is adjourned

for 45 days or more, notice of the adjourned meeting must be given

as in the case of the original meeting.

11.12

Decisions

by Show of Hands or Poll

Subject

to the Business Corporations

Act, every motion put to a vote at a meeting of shareholders

will be decided on a show of hands or the functional equivalent of

a show of hands by means of electronic, telephonic or other

communications facility, unless a poll, before or on the

declaration of the result of the vote by show of hands, is directed

by the chair or demanded by any shareholder entitled to vote who is

present in person or by proxy.

11.13

Declaration

of Result

The

chair of a meeting of shareholders must declare to the meeting the

decision on every question in accordance with the result of the

show of hands (or its functional equivalent) or the poll, as the

case may be, and that decision must be entered in the minutes of

the meeting. A declaration of the chair that a resolution is

carried by the necessary majority or is defeated is, unless a poll

is directed by the chair or demanded under Article 11.12,

conclusive evidence without proof of the number or proportion of

the votes recorded in favour of or against the

resolution.

11.14

Motion

Need Not be Seconded

No

motion proposed at a meeting of shareholders need be seconded

unless the chair of the meeting rules otherwise, and the chair of

any meeting of shareholders is entitled to propose or second a

motion.

In the

case of an equality of votes, the chair of a meeting of

shareholders does not, either on a show of hands or on a poll, have

a second or casting vote in addition to the vote or votes to which

the chair may be entitled as a shareholder or

proxyholder.

11.16

Manner

of Taking Poll

Subject

to Article 11.17, if a poll is duly demanded at a meeting of

shareholders:

(1)

the poll must be

taken:

(a)

at the meeting, or

within seven days after the date of the meeting, as the chair of

the meeting directs; and

(b)

in the manner, at

the time and at the place that the chair of the meeting

directs;

(2)

the result of the

poll is deemed to be the decision of the meeting at which the poll

is demanded; and

(3)

the demand for the

poll may be withdrawn by the person who demanded it.

11.17

Demand for Poll on

Adjournment

A poll

demanded at a meeting of shareholders on a question of adjournment

must be taken immediately at the meeting.

11.18

Chair

Must Resolve Dispute

In the

case of any dispute as to the admission or rejection of a vote

given on a poll, the chair of the meeting must determine the

dispute, and his or her determination made in good faith is final

and conclusive.

On a

poll, a shareholder entitled to more than one vote need not cast

all the votes in the same way.

11.20

No

Demand for Poll on Election of Chair

No poll

may be demanded in respect of the vote by which a chair of a

meeting of shareholders is elected.

11.21

Demand

for Poll Not to Prevent Continuance of Meeting

The

demand for a poll at a meeting of shareholders does not, unless the

chair of the meeting so rules, prevent the continuation of the

meeting for the transaction of any business other than the question

on which a poll has been demanded.

11.22

Retention

of Ballots and Proxies

The

Company or its agent must, for at least three months after a

meeting of shareholders, keep each ballot cast on a poll and each

proxy voted at the meeting, and, during that period, make them

available for inspection during normal business hours by any

shareholder or proxyholder entitled to vote at the meeting. At the

end of such three month period, the Company or its agent may

destroy such ballots and proxies.

PART 12

VOTES OF

SHAREHOLDERS

12.1

Number

of Votes by Shareholder or by Shares

Subject

to any special rights or restrictions attached to any shares and to

the restrictions imposed on joint shareholders under Article

12.3:

(1)

on a vote by show

of hands, every person present who is a shareholder or proxy holder

and entitled to vote on the matter has one vote; and

(2)

on a poll, every

shareholder entitled to vote on the matter is entitled, in respect

of each share entitled to be voted on the matter and held by that

shareholder, to one vote and may exercise that vote either in

person or by proxy.

12.2

Votes

of Persons in Representative Capacity

A

person who is not a shareholder may vote at a meeting of

shareholders, whether on a show of hands or on a poll, and may

appoint a proxy holder to act at the meeting, if, before doing so,

the person satisfies the chair of the meeting, or the directors,

that the person is a legal personal representative or a trustee in

bankruptcy for a shareholder who is entitled to vote at the

meeting.

12.3

Votes

by Joint Holders

If

there are joint shareholders registered in respect of any

share:

(1)

any one of the

joint shareholders may vote at any meeting of shareholders,

personally or by proxy, in respect of the share as if that joint

shareholder were solely entitled to it; or

(2)